Professional Photography to Sell Your Home

Photos are ranked #1 in what buyers want to see on a website and professional photography makes them outstanding. Continue Reading

Photos are ranked #1 in what buyers want to see on a website and professional photography makes them outstanding. Continue Reading

A CLUE report can identify insurance claims on a home to discover whether repairs were done properly. Continue Reading

Inflation devalues the purchasing power of money and the interest earned on savings is almost always less than inflation. Tangible assets like your home consistently become more valuable over time. In inflationary periods, a home is a good investment Continue Reading

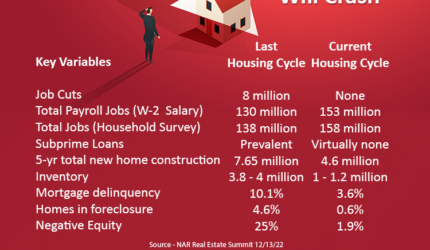

There are significant differences between what caused the housing crisis before and currently which make it unlikely for home price to crash Continue Reading

Credit scores are used to assess risk and determine whether a borrower is approved or declined for a mortgage, credit card or some other type of credit. The score is a numerical value ranging from a low of zero to a high of 850 or 900 depending on the credit Continue Reading

Each of these loans are assumable at your current rate to owner-occupant buyers and can make your home more marketable, possibly, adding value. Continue Reading