Professional Photography to Sell Your Home

Photos are ranked #1 in what buyers want to see on a website and professional photography makes them outstanding. Continue Reading

Photos are ranked #1 in what buyers want to see on a website and professional photography makes them outstanding. Continue Reading

A CLUE report can identify insurance claims on a home to discover whether repairs were done properly. Continue Reading

Inflation devalues the purchasing power of money and the interest earned on savings is almost always less than inflation. Tangible assets like your home consistently become more valuable over time. In inflationary periods, a home is a good investment Continue Reading

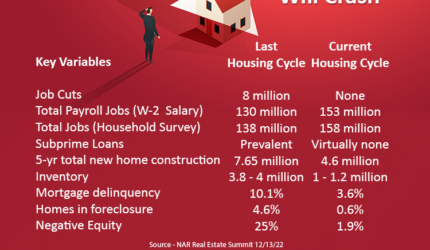

There are significant differences between what caused the housing crisis before and currently which make it unlikely for home price to crash Continue Reading

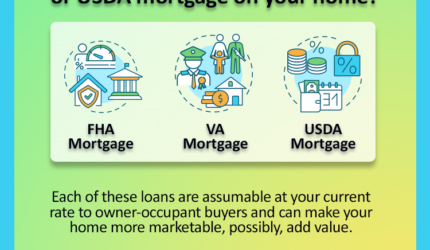

Each of these loans are assumable at your current rate to owner-occupant buyers and can make your home more marketable, possibly, adding value. Continue Reading

Waiting for the mortgage rates to come down before you buy a home may not be a good decision. If you are correct, and the rates do come down by two percent, the savings you benefit from a lower rate will most likely be devoured by the appreciated price increase. As of Continue Reading

A soft second loan, sometimes called a silent second, is subordinate to the first mortgage, whose payment is deferred or forgiven until a specific date or the resale of the property. This would mean that buyers would not have to contend with regular payments thereby Continue Reading